Get Help Paying for Prescription Drugs

Assistance Options for Medicare Beneficiaries

Even with coverage through a Medicare Part D Prescription Drug Plan or a Medicare Advantage Plan with drug benefits, many Medicare beneficiaries still struggle to afford their medications.

One option is to ask your doctor if you can switch to a generic or a lower-cost alternative. However, even with generics, people — especially those with multiple or serious health conditions — may still face high prescription costs.

Fortunately, there are several resources available to help reduce your out-of-pocket expenses:

Medicare Part D Plans with Gap Coverage:

⦁ Some Medicare Part D Prescription Drug Plans offer additional coverage during the "coverage gap" (also called the donut hole).

⦁ These plans can help lower your costs during this phase but may come with higher monthly premiums.

Extra Help" Program

⦁ A federal program that provides financial assistance with prescription drug plan costs, including premiums, deductibles, and copayments.

⦁ Learn more about Extra Help below (or through the Social Security Administration).

Pharmaceutical Assistance Programs

⦁ Many pharmaceutical companies offer assistance programs to help Medicare beneficiaries pay for their medications.

⦁ Check if there’s a program that supports the medications you take:

👉 ⦁ Pharmaceutical Assistance Programs

State Pharmaceutical Assistance Programs (SPAPs)

⦁ Some states provide additional financial assistance for:

⦁ Prescription costs

⦁ Plan premiums

⦁ Other related expenses

⦁ Find out if your state has a program:

👉 State Pharmaceutical Assistance Programs

Charitable Assistance Programs

Several national and community organizations help individuals facing high prescription drug costs:

⦁ National Patient Advocate Foundation:

⦁ National Organization for Rare Disorders:

rarediseases.org - Patient Assistance Programs

⦁ National Council on Aging’s Benefits CheckUp Tool:

Getting "Extra Help"

If you have limited income and financial resources, you may qualify for Medicare’s "Extra Help" program — a resource designed to assist with prescription drug costs.

How Do I Know If I Automatically Qualify?

⦁ Medicare will send you a purple letter if you automatically qualify for Extra Help.

➔ Important: Keep this letter for your records.

⦁ If you receive the purple letter, you don't need to apply separately for Extra Help.

To use Extra Help:

⦁ You must be enrolled in a Medicare Part D Prescription Drug plan.

⦁ If you're not already enrolled, Medicare may automatically enroll you into a plan and will send you a yellow or green letter to inform you when your coverage starts.

⦁ You’ll also get a Special Enrollment Period to change plans if you wish.

Special Note:

⦁ If you have Medicaid and live in a nursing home or receive home and community-based services, you may pay nothing for covered prescription drugs.

What If I Don't Automatically Qualify?

How to Apply for Extra Help

If you didn't automatically qualify, you can apply at any time:

⦁ Apply Online:

Visit ⦁ secure.ssa.gov/i1020/start

⦁ Apply by Phone:

Call Social Security at 1-800-772-1213(TTY users call 1-800-325-0778), Available Monday–Friday, 8 AM–7 PM.

When you apply for Extra Help, you also have the option to start the application for Medicare Savings Programs, which help cover other Medicare costs (like premiums and deductibles).

Social Security will send your information to your state unless you ask them not to on your application.

Need More Help?

⦁ Contact your local State Health Insurance Assistance Program (SHIP) for free, personalized guidance. ➔ Find your SHIP here: ⦁ www.shiptacenter.org

⦁ Read more about Extra Help and eligibility requirements here:

Paying for Medicare Healthcare Costs

Resources to Help Manage Out-of-Pocket Expenses

While Medicare provides important coverage, it is not free and doesn’t cover all healthcare costs.

Even with additional insurance through Medigap or Medicare Advantage plans, there may still be expenses you need help paying.

Fortunately, there are programs available that offer additional financial support:

Medicare Savings Programs

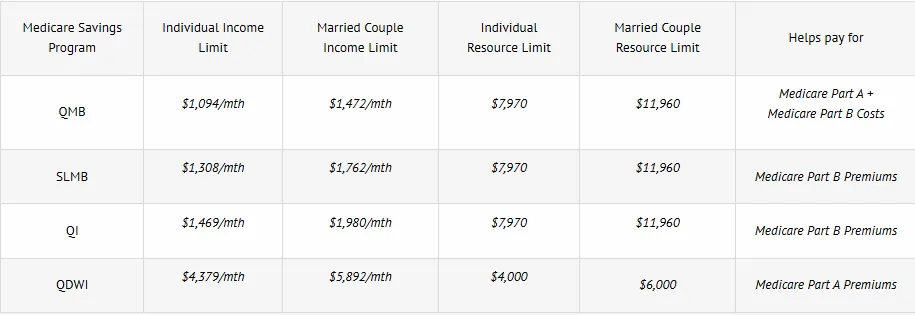

There are four types of Medicare Savings Programs (MSPs) that can help cover costs that Medicare, Medigap, or Medicare Advantage plans may not fully pay.

Note: These programs vary by state.

1. Qualified Medicare Beneficiary (QMB) Program

⦁ Helps pay Part A and/or Part B premiums.

⦁ Also covers deductibles, coinsurance, and copayments for Medicare-covered services (except outpatient prescription drugs).

⦁ Important:

Medicare providers cannot bill you for items and services covered by Medicare if you are in the QMB program.

If you are mistakenly billed, inform your provider or debt collector that you are a QMB participant and request a correction.

If you’ve already paid a bill for services that should have been covered, you have the right to a refund.

Learn more about the QMB program here:

👉 www.benefits.gov/benefit/6177

2. Specified Low-Income Medicare Beneficiary (SLMB) Program

⦁ Assists with paying Medicare Part B premiums only.

Learn more about the SLMB program here:

👉 www.benefits.gov/benefit/6178

3. Qualifying Individual (QI) Program

⦁ Also helps cover Medicare Part B premiums.

⦁ Funding is limited, and applications are approved on a first-come, first-served basis.

⦁ You cannot qualify for QI benefits if you are also eligible for Medicaid.

Learn more about the QI program here:

👉 www.benefits.gov/benefit/6176

Bonus: Extra Help for Prescription Drug Costs

If you qualify for any of the following Medicare Savings Programs:

⦁ QMB (Qualified Medicare Beneficiary)

⦁ SLMB (Specified Low-Income Medicare Beneficiary)

⦁ QI (Qualifying Individual)

You will automatically qualify for Extra Help, which assists with costs related to Medicare Part D Prescription Drug coverage.

Do You Qualify for a Medicare Savings Program?

Typically, to be eligible, your income and resources must fall below certain limits:

1. Qualified Medicare Beneficiary (QMB) Program

⦁ Helps pay Part A and/or Part B premiums.

⦁ Also covers deductibles, coinsurance, and copayments for Medicare-covered services (except outpatient prescription drugs).

⦁ Important:

Medicare providers cannot bill you for items and services covered by Medicare if you are in the QMB program.

If you are mistakenly billed, inform your provider or debt collector that you are a QMB participant and request a correction.

If you’ve already paid a bill for services that should have been covered, you have the right to a refund.

Learn more about the QMB program here:

👉 www.benefits.gov/benefit/6177

2. Specified Low-Income Medicare Beneficiary (SLMB) Program

⦁ Assists with paying Medicare Part B premiums only.

Learn more about the SLMB program here:

👉 www.benefits.gov/benefit/6178

3. Qualifying Individual (QI) Program

⦁ Also helps cover Medicare Part B premiums.

⦁ Funding is limited, and applications are approved on a first-come, first-served basis.

⦁ You cannot qualify for QI benefits if you are also eligible for Medicaid.

Learn more about the QI program here:

👉 www.benefits.gov/benefit/6176

Bonus: Extra Help for Prescription Drug Costs

If you qualify for any of the following Medicare Savings Programs:

⦁ QMB (Qualified Medicare Beneficiary)

⦁ SLMB (Specified Low-Income Medicare Beneficiary)

⦁ QI (Qualifying Individual)

You will automatically qualify for Extra Help, which assists with costs related to Medicare Part D Prescription Drug coverage.

Do You Qualify for a Medicare Savings Program?

Medicare Savings Program (MSP) Qualification

Want to learn more about eligibility standards for each Medicare Savings Program?

👉 Visit: www.medicare.gov/basics/costs/help/medicare-savings-programs

Important:

⦁ Each state has its own rules for calculating income and resources.

⦁ To check if you qualify:

⦁ Contact your State Medicaid office. Find the phone number here:

👉 www.medicaid.gov - State Assistance

Or call 1-800-MEDICARE(TTY: 1-877-486-2048), available 24/7.

Medicaid Overview

Medicaid is a joint federal and state program that helps cover healthcare costs for individuals with limited income and resources.

Some people qualify for both Medicare and Medicaid (dual eligible).

Learn more here: Medicare vs Medicaid.

What Medicaid May Cover:

⦁ If you have both Medicare and full Medicaid, most of your healthcare costs are covered.

⦁ Medicare covers your prescription drugs; Medicaid may still cover medications that Medicare doesn’t.

⦁ Medicaid can also cover:

- Nursing home care

- Personal care services

- Transportation to medical appointments

- Home- and community-based services

- Dental, vision, and hearing services

Programs of All-Inclusive Care for the Elderly (PACE)

PACE is a program available in many states that allows eligible seniors to remain in their communities rather than move to a nursing home.

To qualify for PACE, you must:

⦁ Be 55 years or older.

⦁ Live in the service area of a PACE organization.

⦁ Be certified as needing nursing home-level care.

⦁ Be able to live safely in the community with PACE services.

PACE Services Include:

⦁ Prescription drugs

⦁ Medical care and specialist visits

⦁ Transportation

⦁ Home health care

⦁ Hospital visits

⦁ Nursing home stays (if needed)

Costs:

⦁ If you have Medicaid, you pay no monthly premium for long-term care through PACE.

⦁ If you have Medicare only, you’ll pay a monthly premium for long-term care and Medicare Part D coverage.

⦁ No deductibles or copayments for services or drugs approved by the PACE team.

Learn more here:

👉 www.medicare.gov - PACE Program

Supplemental Security Income (SSI) Benefits

SSI provides cash benefits through Social Security to people who are:

⦁ 65 or older,

⦁ Blind,

⦁ Or have a disability,

and have limited income and resources.

Important Notes:

⦁ SSI is not the same as Social Security retirement benefits.

⦁ You may qualify for both SSI and Social Security if your retirement benefit is low.

⦁ If you qualify for SSI, you automatically:

⦁ Receive Extra Help with Medicare prescription drug costs,

⦁ And are usually eligible for Medicaid.

Check your eligibility here:

👉 SSA Benefits Screening Tool

Or call Social Security at 1-800-772-1213(TTY: 1-800-325-0778) for assistance.

Learn more about SSI here:

Copyright © 2012–2025 Powered by SBI Benefits. All Rights Reserved

Disclaimer | Privacy Policy | Sitemap Mailing Address:

We do not offer every plan available in your area. We currently represent 20 organizations offering 56 products. For a complete list of options, contact Medicare.gov, 1-800-MEDICARE, or your State Health Insurance Program (SHIP). By submitting your contact information, you consent to receive marketing communications from Akeem Grant, including calls and texts (automated, AI-generated, or pre-recorded). Message and data rates may apply. Consent is not required for enrollment and can be withdrawn at any time, even if your number is on a Do Not Call list.